Introduction

Freelancers often find themselves wearing multiple hats, from project management to client relations and, most crucially, financial management. Xolo, a leading financial management platform, aims to simplify this intricate aspect of freelancing. This article will guide you through how to issue invoices with Xolo and who can use it, focusing on the various nationalities that can benefit from this platform.

What is Xolo?

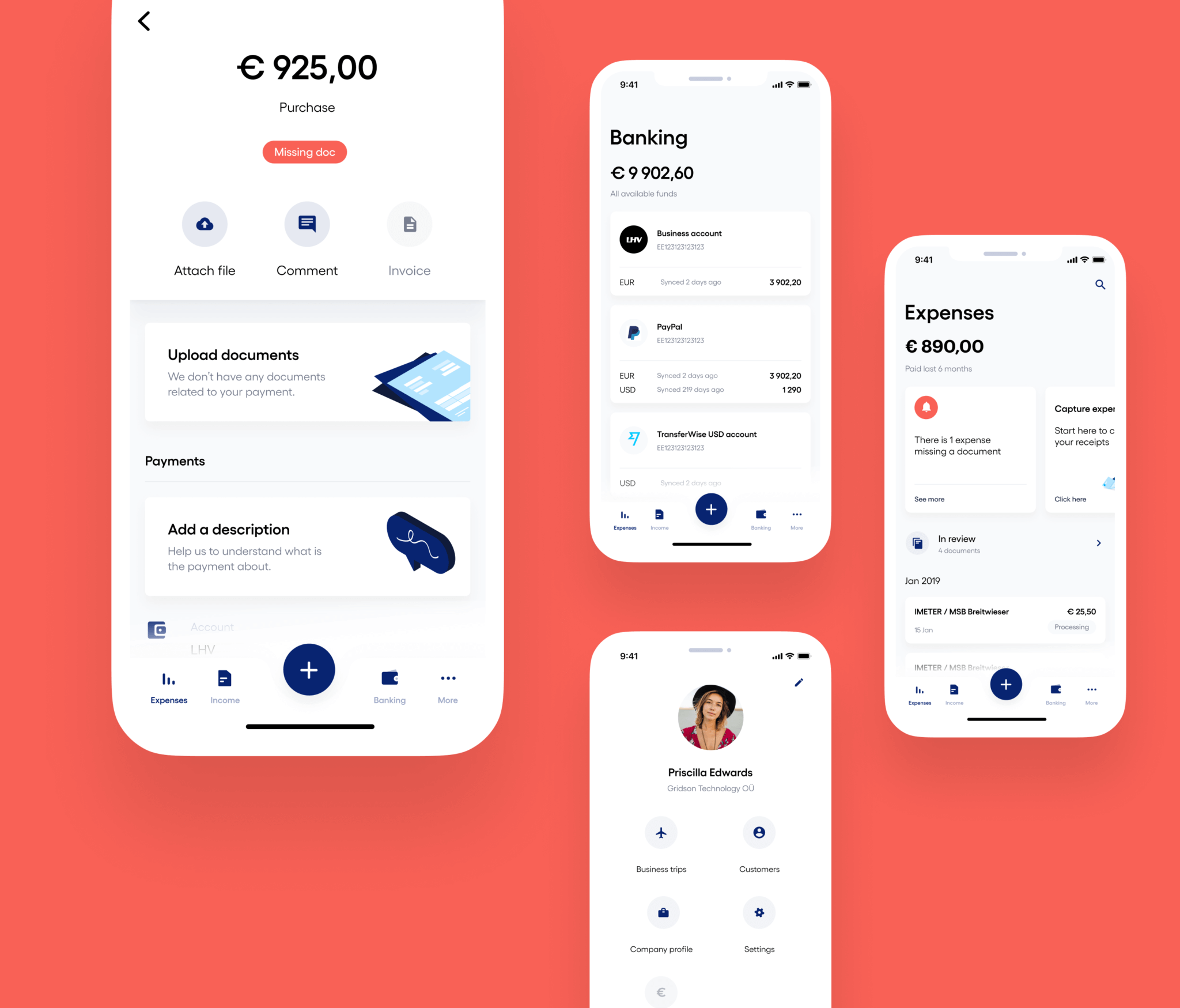

Xolo is a financial management platform designed to make freelancers’ lives easier. Once you sign up for Xolo Go, you are instantly provided with an EU bank account number, making it easier for clients to pay you. The platform also offers a simple accounting software to manage and create invoices, and even allows you to track when invoices are opened.

How to Issue Invoices with Xolo

Step 1: Sign Up for Xolo Go

The first step is to sign up for Xolo Go. Once you complete the registration process, you will receive an EU bank account number.

Step 2: Navigate to the Invoicing Section

Log in to your Xolo dashboard and navigate to the invoicing section. Here, you can create new invoices with ease.

Step 3: Fill in Invoice Details

Fill in all the necessary details such as client information, services rendered, and the amount due. Xolo’s intuitive design makes this process straightforward.

Step 4: Send the Invoice

Once you’ve filled in all the details, you can send the invoice directly to your client’s email from the Xolo platform. You can also track when the invoice is opened, giving you an idea of when to expect payment.

Step 5: Manage and Track Invoices

Xolo allows you to manage all your invoices in one place. You can track payments, view pending invoices, and even integrate with accounting tools like QuickBooks for more comprehensive financial management.

Who Can Use Xolo?

Xolo is primarily aimed at freelancers and small business owners. While the platform is based in the EU, it is not limited to European nationals. Freelancers from various countries can use Xolo, especially those who have clients in the EU, as it provides an EU bank account number for easier transactions.

Why Choose Xolo?

Time-Saving Automation

Xolo automates essential financial tasks like invoicing and expense tracking, saving you valuable time.

Comprehensive Financial Solutions

From credit card processing to tax preparation, Xolo offers a wide range of financial services tailored for freelancers.

Security and Compliance

Xolo is fully compliant with financial regulations and offers robust data security features, giving you peace of mind.

Exceptional Customer Support

With 24/7 customer support and a wealth of online resources, Xolo ensures you’re never alone in your financial management journey.

Conclusion

Xolo offers a comprehensive, secure, and user-friendly platform for freelancers looking to simplify their financial management. Its invoicing feature is particularly useful, making it easier to issue invoices and get paid. With its focus on automation, security, and support, Xolo is more than just a financial management tool; it’s a partner committed to your freelance success.

Ready to take control of your freelance finances? [Get started with Xolo today!](Xolo Referral Link)

By leveraging the power of Xolo, you’re not just choosing a financial management tool; you’re choosing a partner committed to your freelance success.

Get Started with Xolo Today!

Interested in taking control of your freelance finances with Xolo? Use our referral link to get started: Xolo Referral Link.

By leveraging the power of Xolo, you’re not just choosing a financial management tool; you’re choosing a partner committed to your freelance success.